Tax automation software for NZ property investors

Reduce compliance costs and automate property tax filing.

Why you'll love Casary?

Easy to use

Casary guides you through the tax filing process step by step through an intuitive interface, designed for non-accountants.

Extend your filing date

By filing with Casary, you will get an extension of time on the tax return and terminal tax payment due date, provided certain conditions are met.

Save money and ease cashflow

1% of gross rental income* per return. No upfront or monthly fees. Do taxes yourself without compromising on quality and accuracy.

NZ tax compliant

Casary is built by NZ property tax specialists. We perform extensive testing and validation of the software to ensure accuracy and compliance with NZ tax law so you have peace of mind that your tax return is done correctly.

How Casary works?

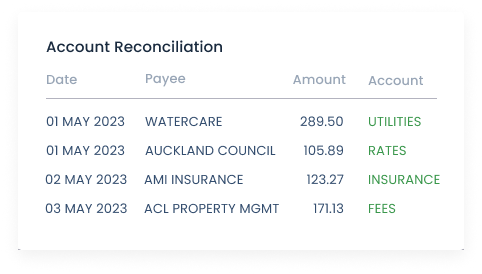

Connect your rental bank accounts to Casary to sync across your transactions.

Casary analyses your transactions and automatically reconciles them for you saving you time and hassle.

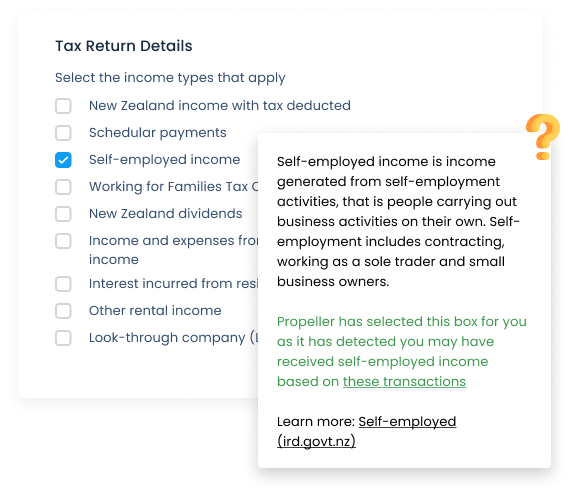

Casary guides you through the tax filing process with informative commentary and auto-filled suggestions.

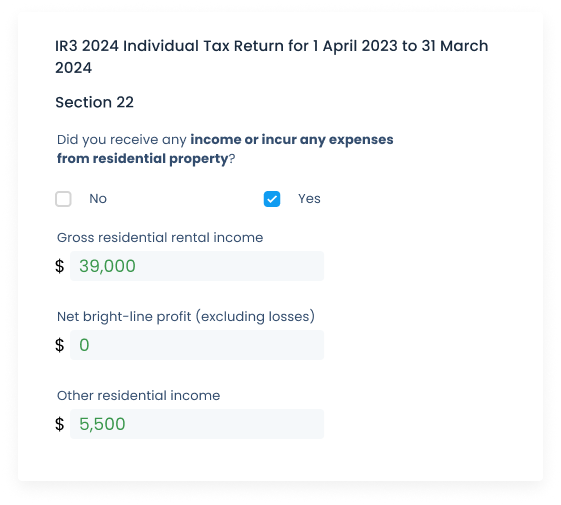

Casary calculates and populates the numbers in your tax return form for review. After review, e-file directly to IRD from within Casary.

Features

Automatic bank reconciliation

Automatically categorise and reconcile your bank transactions with built in AI.

Tax calculations

Calculate your profit and loss, your tax position, and generate your IR3 and IR3R forms with numbers pre-populated.

Data feeds

Securely connect and synchronize data from IRD, banks and external data sources.

Generate reports

Generate profit and loss reports to track performance and make informed investment decisions in a timely manner.

Manage fixed assets

Generate depreciation schedules and calculate depreciation for your fixed assets.

Electronic filing

Electronically file your tax return forms to IRD from within Casary.

How does it compare?

| Casary | Accounting Firm not using Casary | Spreadsheet | |

|---|---|---|---|

| Cost | 1% of gross rental income * | From NZD800 per return (for one property) | Free |

| High accuracy with built-in tax rules and validations |  |  |  |

| Updated regularly to adhere to changes in NZ tax laws |  |  |  |

| Secure synchronization and automatic reconciliation of bank feeds |  |  |  |

| Generate individual income tax return form (IR3) and rental income form (IR3R) |  |  |  |

| Generate depreciation schedules |  |  |  |

| Extension of time |  |  |  |

| Self pace |  |  |  |

| Easy to use or engage with |  |  |  |

| Dedicated customer support |  |  |  |

* Minimum charge of NZD350 + GST, maximum charge capped at NZD2,000 + GST.

Built by property tax specialists

Casary was originally built for NZ International Tax and Property Advisors (NZTP) as an internal software tool for their clients. Given strong interests from NZTP’s prospects to use the software, we are releasing Casary to external users. We anticipate Casary to be used by other property accountants in the near future.

Casary will continue building the software with NZTP to ensure the software is compliant with New Zealand tax laws.

Are you a property advisor?

Our partnership program offers a number of benefits to our partners and their clients to help them succeed in their property journey. If you are interested to become a Casary partner, join our advisor mailing list.

Can I use Casary?

- Property held in your personal name;

- NZ tax resident; and

- receive long term residential rental income.

In future rollouts, Casary plans to expand to accommodate:

- offshore individual investors;

- NZ companies;

- NZ trusts;

- short term residential income; and

- commercial rental income.

To get notified when the rollout happens, simply enter your details in the form and follow us on social media.

FAQs

How much does Casary cost?

Casary’s pricing is 1% plus GST on gross rental income, capped at a maximum of NZD2,000 plus GST per year. There is a minimum charge of NZD350 plus GST per year, but this will be waived in the first six month of launch.

If you need additional support, such as reviewing the return before lodgement with IRD or preparing and filing the return on your behalf by our in-house property tax specialists, contact us and we can provide these services to you for an additional fee.

Which year of the NZ income tax return can I start using Casary?

We expect to launch Casary around late 2025.

You can start using Casary for the 2025 and future NZ income tax returns.

If you’d like to be posted re software update and gaining early access, please sign up to our mailing list.

Can I seek support from my existing accountant instead of Casary's property tax specialists?

Absolutely! We plan to design Casary so it is accessible and usable for all accountants.

Can I use Casary if I derive other sources of income in addition to rental income?

Depends on what type of income you derive.

If you derive NZ sourced income where tax is deducted at source, the taxable income and withheld tax will automatically be feed through to Casary from your IRD records which will be straight forward.

If you derive NZ sourced income where tax is not deducted at source or overseas sourced income, there may or may not be complexity in calculating the taxable income. Hence, we suggest you consult with a Casary property tax specialist or a tax accountant to ensure the correct figures are entered into Casary prior to filing with the Inland Revenue.

Which type of advisors can become Casary partner?

Any property related advisors including lawyer, mortgage brokers, accountants and financial advisors. Join our advisor mailing list to get posted on news and partners discount.